The answer is hiring the best bankruptcy attorney Triangle VA to advice and guide you. One of the myths that circulates about bankruptcy is that you lose everything you own when you file bankruptcy.

Can I Keep My Car If I Go Bankrupt Bankruptcy Advice Online

Can I Keep My Car If I Go Bankrupt Bankruptcy Advice Online

You can find out what youll be able to keep by checking the exemption statutes in your state.

How to go bankrupt and keep everything. However there are other alternatives to consider. In fact there are several ways you can go bankrupt. A bankruptcy attorney can review your situation and explain what will happen to your property as well as the cost to file for Chapter 7.

Another option is to declare chapter 13 bankruptcy. To start to go bankrupt you first need to create an online account. An important factor on whether youll get to keep your property in bankruptcy is whether the Official Receiver OR - the person appointed by the courts to investigate your finances - thinks youve got any beneficial interest.

Most people who file bankruptcy under Chapter 7 do not have to surrender anything to their trustee because everything they own is exempt Generally Yes You Can Keep Everything Even though Chapter 7 is labeled the liquidation form of bankruptcy most people who file under this simplest and most common form of bankruptcy keep everything they own. Today were taking a look at how to avoid bankruptcy in business. At the the moment the application may not work on some mobile phones.

Whether you own the car already or you have a car loan its possible to keep your car in a Chapter 13 bankruptcy. Having a meticulous budget discipline to stick with the budget and keeping a keen eye for detail will help keep your business afloat. People who file for bankruptcy who are earning money are also allowed to keep some of their income to cover living costs.

For many this means the possibility of bankruptcy has moved from a last resort to a reality. You would go this route in case you dont qualify for option a or b above. We suggest you use a laptop or desktop if.

In a Chapter 13 bankruptcy you go into a repayment plan for your debts so you can keep your assets as long as you keep paying what was agreed. If you could afford to pay 2000 for a beater you could buy some cheap wheels for basic transportation. This is what we call the Chapter 7 Liquidation Analysis So if you have non-exempt equity in your house of 12000 youd have to pay your general unsecured creditors that same 12000 over five years in a.

Household equipment such as a. If you do not live in England or Wales. It will also tell you how to apply for bankruptcy and how creditors can make you bankrupt.

This is a workout plan rather than a way for you to get a clean slate. You can get free advice from a debt adviser to help you decide how to deal with your debts. Bankruptcy law allows you to exempt or take out of the bankruptcy estate the things you need to maintain a home and job such as household furnishings clothing and an inexpensive car.

So if your state has an exemption amount of 75000 and the equity in your home is 75000 you can keep your home even though it has equity and still declare chapter 7 bankruptcy to get relief from the other debt. If youre in deep trouble due to lack of funds and the sudden decline in your finances you need to be immediate in your responses. Bury yourself in credit card debt more than you can ever repay Pour all your money down the toilet Buy an expensive loan that your income wont cover in the future Buy your kids everything they want Lend your friends a lot of money and forget Never skip a sale.

Filing for bankruptcy can seem like a constant threat to businesses across the board. That is the property that neither a creditor with a judgment or a bankruptcy. Thats your beneficial interest.

You could always hand the car back and stick the remaining debt in the Chapter 13 bankruptcy but then how are you going to get back and forth to work. You do this on the apply-for-bankruptcyservicegovuk website. Tools books and other items of equipment that you need to use personally in your job business or vocation.

Going bankrupt is one option for clearing your debts and making a fresh start but it can have serious consequences. The new bankruptcy law requires credit counseling prior to bankruptcy filings anyway so its worth it to strongly consider credit counseling as a bankruptcy alternative. This means you can usually keep the following items unless the trustee thinks they can be replaced with a suitable and cheaper alternative.

Youll find additional information about exempting property in the Chapter 7 exemption overview article as well as answers to specific exemption questions in the Chapter 7 bankruptcy exemption FAQ. The debt management plan payments may seem out of reach but if you look you may find holes in your budget that allow you to make. Keep in mind that your case is unique.

How to Go Bankrupt Without Losing Everything. This property is defined in exemptions. Register for your online bankruptcy application.

These pages will tell you how bankruptcy works and help you decide whether its right for you. You can also contact the National Debtline for bankruptcy advice. In a Chapter 13 you keep everything exempt or not.

So going bankrupt is easier than most people realize. Advanced Wireless Forms provides you with the flexibility to streamline workflow while cutting costs and keeping your business productive. What you need is to assess your needs and evaluate all possible options and possible solutions that will allow you to go through.

A consumer credit counselor can work with you and your creditors to put together a debt management plan to repay your debts over three to five years. But you have to pay your general unsecured creditors over time at least what they would receive were your case a Chapter 7. One of the basic ideas of debtorcreditors rights in this country is that no matter how much they owe debtors can retain certain property for basic living or a fresh start.

Read on to learn the strategies that could help your company manage existing debt ease your financial burden and save your brand image.

Legal Problems With Going Bankrupt

Legal Problems With Going Bankrupt

Bankruptcy What Happens When You Go Bankrupt Bbc News

Bankruptcy What Happens When You Go Bankrupt Bbc News

/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png) Bankruptcy Discharge What Is It

Bankruptcy Discharge What Is It

Legal Matters If I Go Bankrupt Will I Lose Everything Or Can I Keep Certain Assets

Legal Matters If I Go Bankrupt Will I Lose Everything Or Can I Keep Certain Assets

Coronavirus Bankruptcy Tracker These Major Companies Are Failing Amid The Shutdown

Coronavirus Bankruptcy Tracker These Major Companies Are Failing Amid The Shutdown

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png) What You Need To Know About Bankruptcy

What You Need To Know About Bankruptcy

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png) What You Need To Know About Bankruptcy

What You Need To Know About Bankruptcy

How To Claim Bankruptcy And Keep Your Car

How To Claim Bankruptcy And Keep Your Car

In Search Of New Legislation To Keep Businesses From Going Bankrupt Bbva

In Search Of New Legislation To Keep Businesses From Going Bankrupt Bbva

Tips On How To Keep Your Business From Going Bankrupt

Tips On How To Keep Your Business From Going Bankrupt

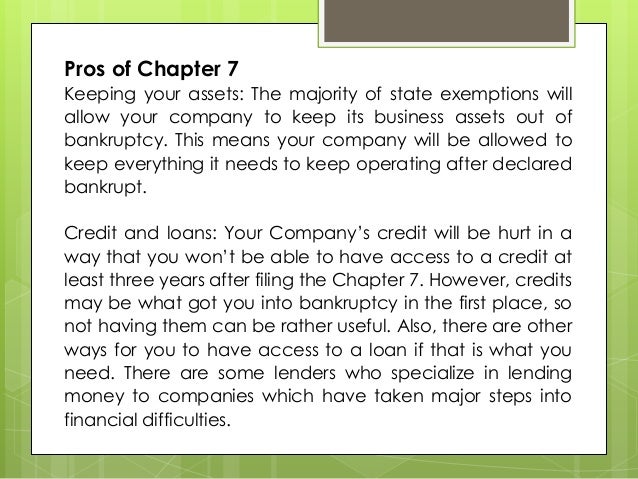

Pros And Cons Of The Bankruptcy Process Under Chapter 7

Pros And Cons Of The Bankruptcy Process Under Chapter 7

5 Signs A Company Is About To Go Bankrupt The Motley Fool

5 Signs A Company Is About To Go Bankrupt The Motley Fool

/GettyImages-184324155-1ae5c089b1c840c3a9070ac039027d78.jpg)

Geen opmerkingen:

Een reactie posten

Opmerking: Alleen leden van deze blog kunnen een reactie posten.