This calculator provides useful guidance but it should be seen. This was the basic rule of thumb for many years.

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Bhhs Fox Roach

This mortgage example illustrates the monthly mortgage repayments on a 7000000 Mortgage with different repayment terms years to illustrate how changing the amount you pay each month can dramatically reduce the total amount of interest you pay on your mortgage as well as helping you to repay your mortgage over a shorter term and become mortgage free.

70k income mortgage. Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 70000 to cover the total cost of debt payment s insurance and property tax. Two parent two child household earning 70k is richer than 88 of population. 45 Estimated home value.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 251 monthly payment. Not sure how much you.

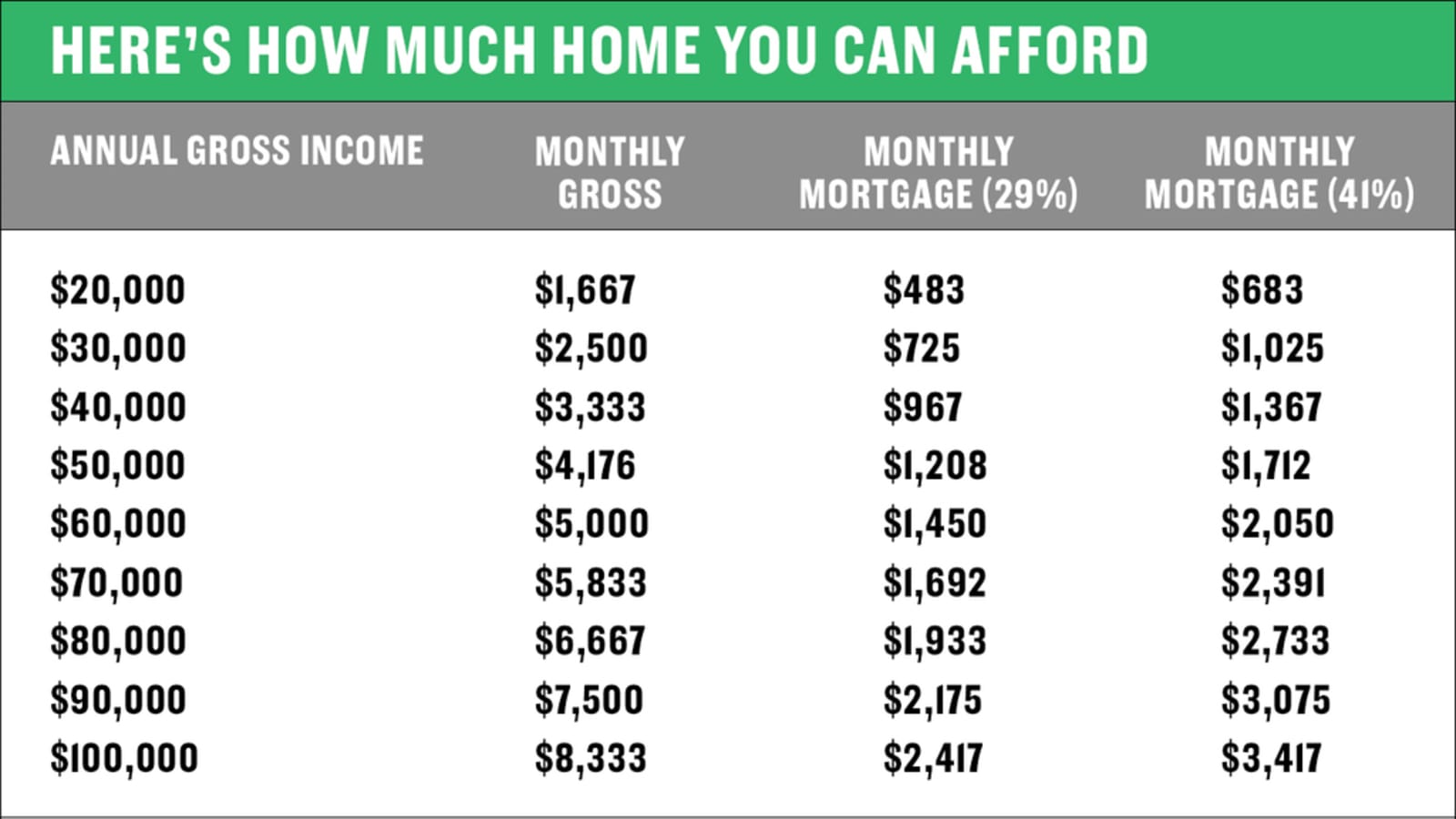

Thats the general rule though they may go to 41 percent. To be able to afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and upwards. 70k over 15 years at 1.

For example with a 30-year loan term and a 4 interest rate you would need an annual income of 97934 and a total monthly payment of 2285. One in six households said they would start using their overdraft on January 10. For those who are self-employed you must provide additional.

For somebody making 100000 a year. As a rule of thumb mortgage lenders dont want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations including the mortgage you are seeking. 70k over 15 years at 25.

Try adjusting the down payment and loan length to see different payment options. 8 Types of Mortgage Loans for Buyers and Refinancers by Hal M. 70k over 15 years at 175.

361 Zeilen How much would the mortgage payment be on a 70K house. Some lenders count overtime income in full while others may only count it at a reduced rate of 50. 70k over 15 years at 3.

This easy and mobile-friendly calculator will compute the payment on a 70000 house with a loan at 400. 70k over 15 years at 15. Assuming you have a 20 down payment 14000 your total mortgage on a 70000 home would be 56000.

70k over 15 years at 275. Whats the monthly mortgage payment on a 70k house. This consists of your basic income including pension other earnings from overtime income workplace bonuses and sales commissions.

70k over 15 years at 2. 343 Zeilen This calculates the monthly payment of a 70k mortgage based on the amount of the. We calculate this based on a simple income multiple but in reality its much more complex.

70k over 15 years at 225. 151 Zeilen Use this to calculate a loan for anything such as a vehicle business loan home RV. How did Research Maniacs calculate how much house you can afford if you make 70000.

Simply take your gross income and multiply it by 25 or 3 to get the maximum value of the home you can afford. It also considers pensions and any financial support you receive from an ex-spouse. 70k over 15 years at 125.

The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including housing costs is no more than 40 of your gross houshold income. Bundrick CFP Holden Lewis Fixed-rate adjustable-rate FHA VA and jumbo mortgages each.