Aaa is the highest rating a corporate bond can get and is considered investment grade. Its based on the Bank of America Merrill Lynch US Corporate Master Index for corporate debt in the A to AAA range.

What S In A Aa Credit Rating Liberty Street Economics

The Moodys Seasoned Aaa Corporate Bond Yield measures the yield on corporate bonds that are rated Aaa.

Triple aaa corporate bonds. On this page is an investment grade corporate bond return calculator which allows you to compute the total return of investment grade corporate bonds. View the average monthly yields of prime investment-grade bonds with maturities over 20 years which can indicate interest rates. AAA members also receive exclusive discounts.

Highly-rated corporate bonds constitute a reliable source of income for a portfolio. Up to 10 cash back AAA offers 24-hour emergency road service plus travel and insurance services. This is lower than the long term average of 409.

Of the three corporates rated triple-A Microsoft has the least favorable debt-to-equity ratio of 209. Now there are currently only four bonds from US companies in this category that have the highest possible rating and the credit rating of the USA has been lowered below AAA for the first time ever. Rated bonds fall into one of two categories.

The HQM methodology projects yields beyond 30 years maturity out to 100 years maturity to get discount rates for long-dated pension liabilities. The iShares Aaa - A Rated Corporate Bond ETF seeks to track the investment results of an index composed of Aaa to A or equivalently rated fixed rate US. Moodys Seasoned Aaa Corporate Bond.

Corporate bonds are rated based on their default probability health of the corporations debt structure as well as the overall health of the economy. Dollars which tend to have more credit risk than government or agency-backed bonds. Standard Poors Moodys and Fitch.

Total debt is just shy of 12 billion while total capital stands at 69 billion. See reviews photos directions phone numbers and more for Triple Aaa locations in Redmond WA. Corporate bond portfolios concentrate on investment-grade bonds issued by corporations in U.

Dollar-denominated bonds issued by US. The most reliable least risky bonds are rated triple-A AAA. The AAA corporate bonds list is much shorter today than it was even 15-20 years ago.

US Corporate AAA Effective Yield is at 198 compared to 198 the previous market day and 186 last year. Corporate bonds are generally rated by one or more of the three primary ratings agencies. Investment grade or.

They can help you accumulate money for. These firms base their ratings on the bond issuers financial health and likely ability to make interest payments and return the bondholders principal. It estimates daily returns from 1996 until today and can adjust for inflation on the CPI index.

The HQM yield curve uses data from a set of high quality corporate bonds rated AAA AA or A that accurately represent the high quality corporate bond market.

Historical Returns Of Corporate Bonds Mindfully Investing

Historical Returns Of Corporate Bonds Mindfully Investing

Moody S Seasoned Aaa Corporate Bond Yield Aaa Fred St Louis Fed

Moody S Seasoned Aaa Corporate Bond Yield Aaa Fred St Louis Fed

In China Not All Triple A Rated Bonds Are Created Equal Wsj

In China Not All Triple A Rated Bonds Are Created Equal Wsj

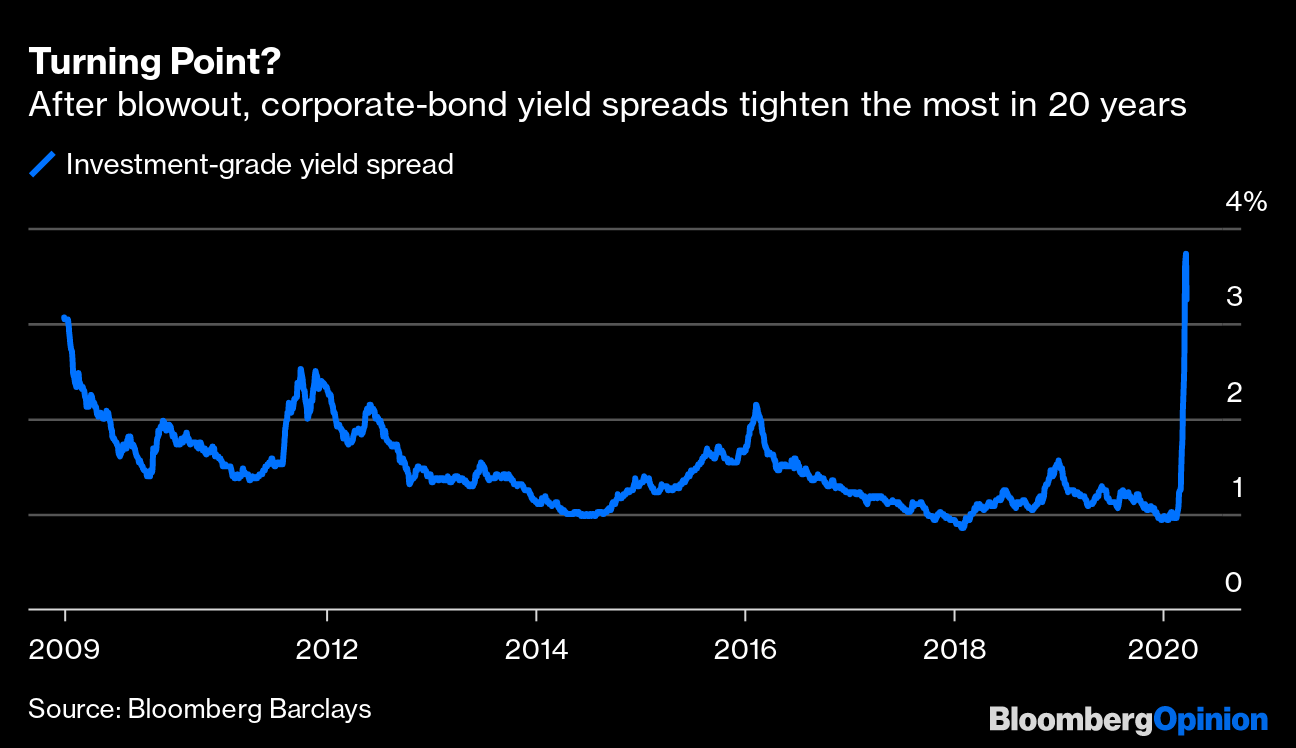

Coronavirus Sorts Bond Market Into Winners And Losers Bloomberg

Coronavirus Sorts Bond Market Into Winners And Losers Bloomberg

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-902863740-65a3b7566cd04de0ae802e1c15402c3a.jpg) Triple A Aaa Bond Rating What Is It

Triple A Aaa Bond Rating What Is It

Maryland Retains Triple Aaa Bond Rating To Sell Up To 800 Million Of General Obligation Bonds Thebaynet Com Thebaynet Com Articles

Maryland Retains Triple Aaa Bond Rating To Sell Up To 800 Million Of General Obligation Bonds Thebaynet Com Thebaynet Com Articles

Historical Returns Of Corporate Bonds Mindfully Investing

Historical Returns Of Corporate Bonds Mindfully Investing

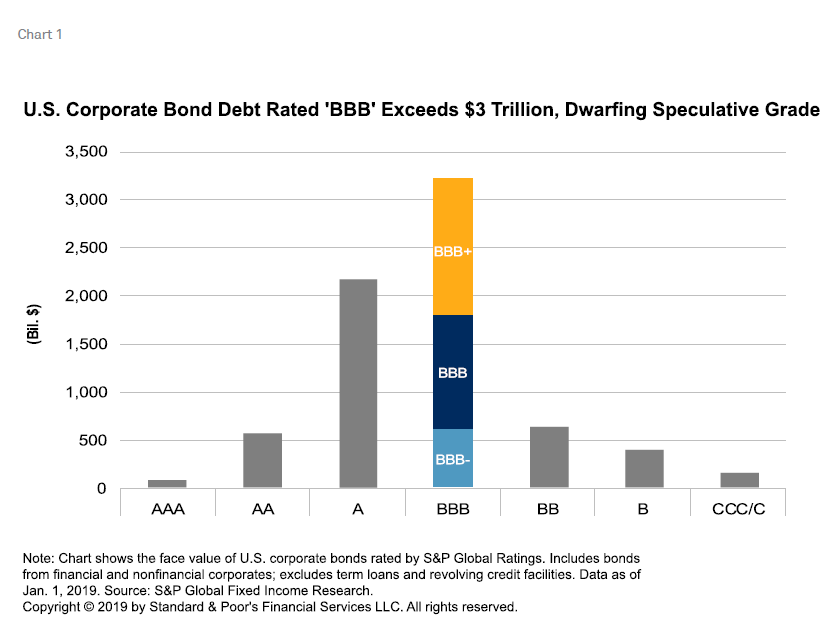

The Bbb U S Bond Market Exceeds 3 Trillion S P Global

The Bbb U S Bond Market Exceeds 3 Trillion S P Global

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

Geen opmerkingen:

Een reactie posten

Opmerking: Alleen leden van deze blog kunnen een reactie posten.